douglas county nebraska car sales tax

Additional fees collected and their distribution for every motor vehicle registration issued are. For vehicles that are being rented or leased see see taxation of leases and rentals.

Nebraska Sales Tax Small Business Guide Truic

Department of Motor Vehicles.

. 3 rows Douglas County NE Sales Tax Rate. Nebraska SalesUse Tax and Tire Fee Statement. 1819 Farnam Omaha NE 68183 402 444-7103.

Has impacted many state nexus laws and sales tax collection requirements. When a motor vehicle dealer exercises the buy-out option for the lessee the dealer may purchase the vehicle without sales tax if the vehicle is being purchased for resale. Average Local State Sales Tax.

Original or copy of the front and back of the title or a copy of the bill of sale listing the date and time of vehicle sale notarized or signed under penalty of perjury. 2020 Net Taxable Sales. The current total local sales tax rate in Douglas County NE is 5500.

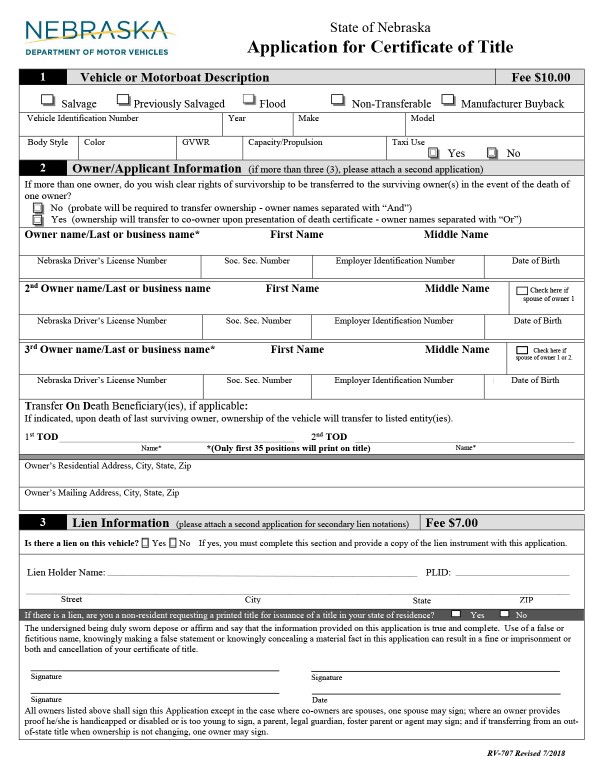

Maximum Possible Sales Tax. This is the total of state and county sales tax rates. All signatures required on the Application for Certificate of Title and on the actual Certificate of Title when transferring ownership must be original signatures.

The 2018 United States Supreme Court decision in South Dakota v. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Nebraska Exemption Application for Sales and Use Tax 062020 4.

The minimum combined 2022 sales tax rate for Douglas County Nebraska is. Questions regarding Decedents Motor Vehicle may be addressed by email or by phone at 4024713918. Registration is required with each vehicle purchase to establish ownership and link the car to the purchaser.

The lessor must issue a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. To remain in Nebraska more than 30 days from the date of purchase. Nebraska Exemption Application for Common or Contract Carriers Sales and Use Tax - Includes Schedule A 072018 5.

200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. While many counties do levy a countywide. Because this trucks MSRP is about 40000 the first year of motor vehicle tax is 700.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Maximum Local Sales Tax. State of Nebraska and the county seat of Lancaster County.

Please contact the Colorado Dept. The December 2020 total local sales tax rate was also 5500. Money from this sales tax goes towards a whole host of state-funded projects and programs.

If the same truck was registered outside the city limits in York County which has no wheel tax and no local sales tax the bill would look like this. While many counties do levy a countywide. Fast Easy Tax Solutions.

2021 Net Taxable Sales. 301 Centennial Mall South PO Box 94789 Lincoln NE 68509- 4789 402 471-3918 State of Nebraska. Purchase of a 30-day plate by a nonresident of Nebraska who does not intend.

The fee for the temp tag is 703. Ad Find Out Sales Tax Rates For Free. 10 rows Douglas County Has No County-Level Sales Tax.

Early payments for the current year taxes may be processed online starting December 1st with statements being mailed each year by Mid-December. The cost to register your car in the state of NE is 15. Real Property Tax Search Please enter either Address info or a Parcel Number.

Real Property Tax Search Please enter either Address info. 2915 NORTH 160TH STREET. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

The current total local sales tax rate in Douglas. Motor Vehicle Dealer Exercises the Buy-out. Copy of current VIN-specific proof of insurance.

50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. The Douglas County sales tax rate is. Resources for Nebraska county treasurers and vehicle dealerships.

Sales and Use Tax Regulation 1-02202 through 1-02204. The lessor must issue a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. Department of Revenue Current Local Sales and Use Tax Rates.

2020 Sales Tax 55. Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4There are a total of 528 local tax jurisdictions across the state collecting an average local tax of 1977. 2021 Sales Tax 55.

Next year there will be no sales tax due while the motor vehicle tax will decline to 630. Nebraska State Sales Tax. County Treasurers Dealers and Insurance Providers.

No electronic signatures may be used. The bill of sale must be signed by both the buyer and seller. The current total local sales tax rate in Douglas County NE is 5500.

The County sales tax rate is. Arizona Sales Reverse Sales Tax Calculator Dremployee Vehicle And Boat Registration Renewal Nebraska Dmv. Nebraska SalesUse Tax and Tire Fee Statement for.

150 - State Recreation Road Fund - this fee. The Nebraska sales tax on cars is 5. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska.

The Nebraska state sales tax rate is currently. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special.

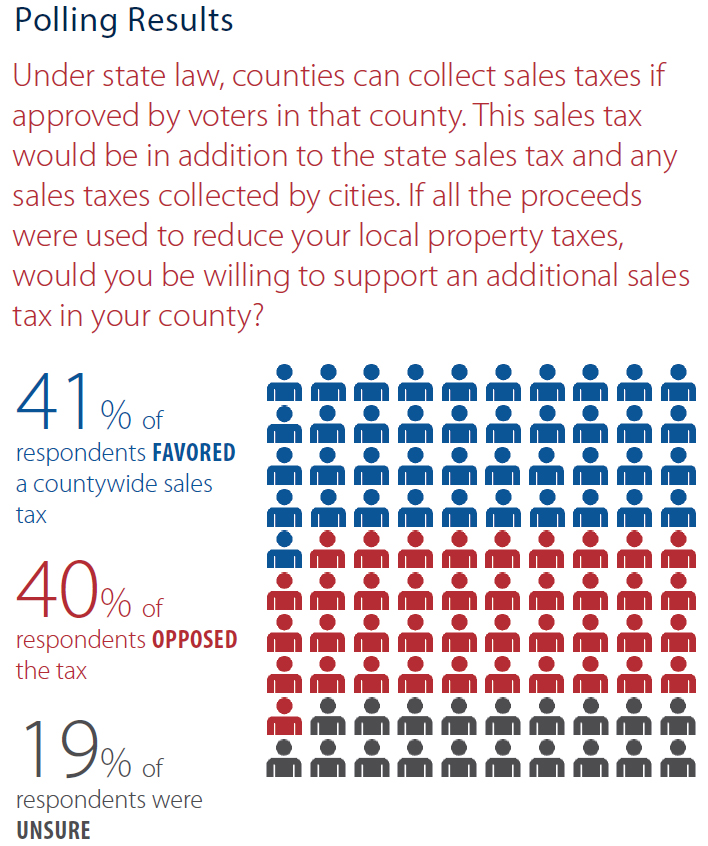

Not Going To Be Able To Afford This Homeowners Worry About Property Taxes As Valuations Rise

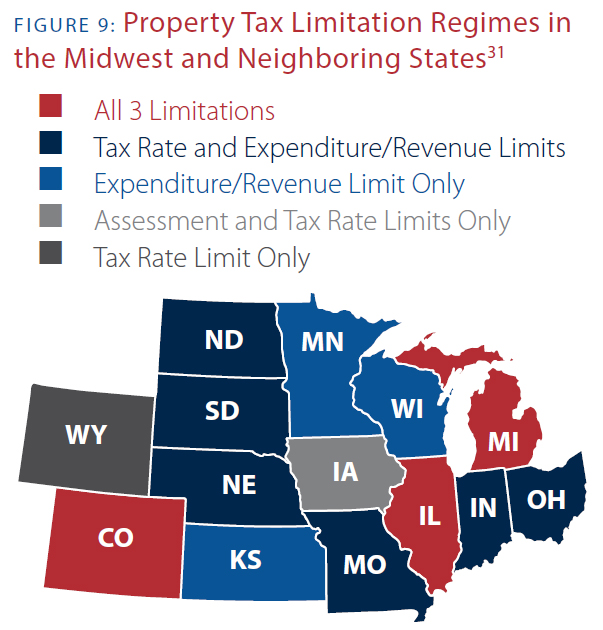

Get Real About Property Taxes 2nd Edition

Motor Vehicles Douglas County Treasurer

How The Nebraska Wheel Tax Works Woodhouse Nissan

Sales Tax On Cars And Vehicles In Kansas

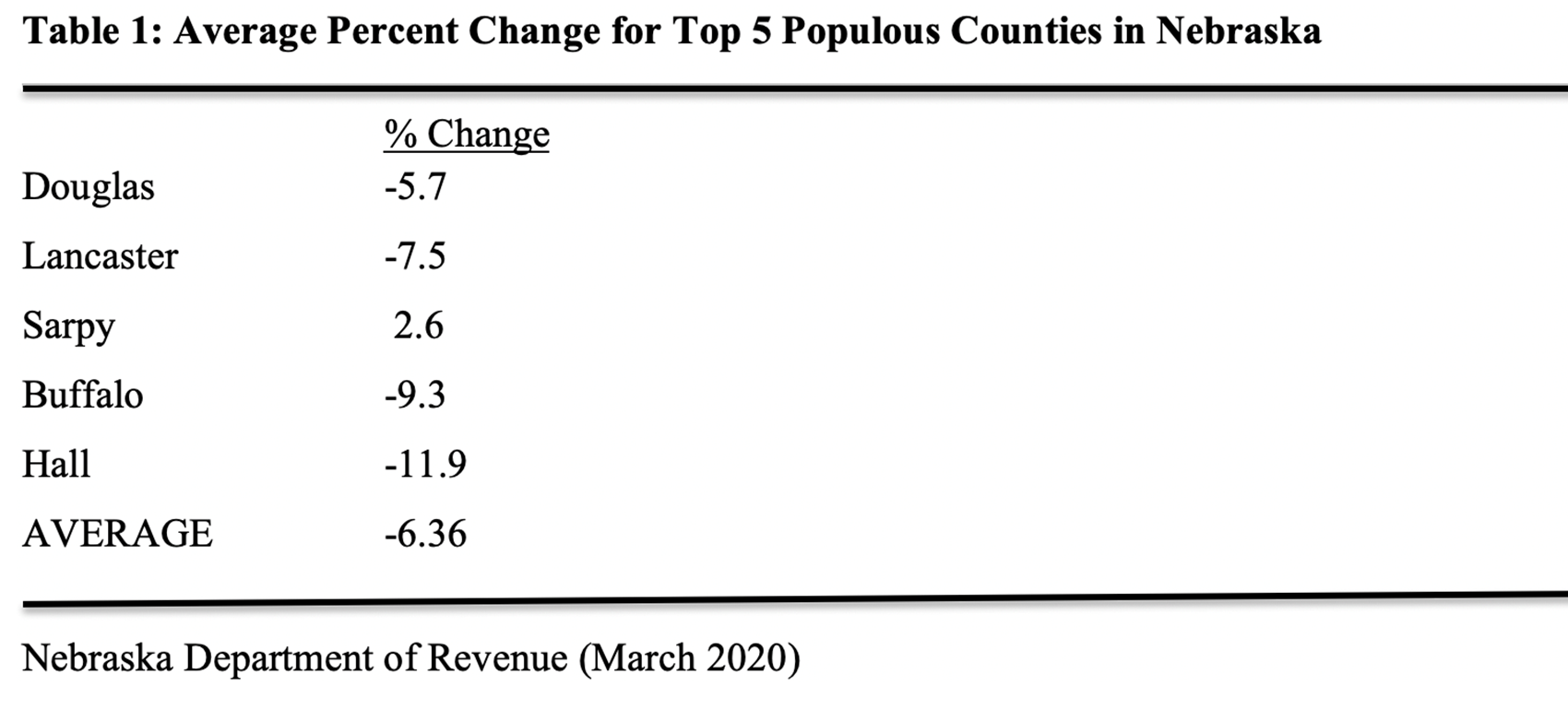

Sales Tax Receipts Hit Harder In Most Populated Nebraska Counties

Get Real About Property Taxes 2nd Edition

Vehicle And Boat Registration Renewal Nebraska Dmv

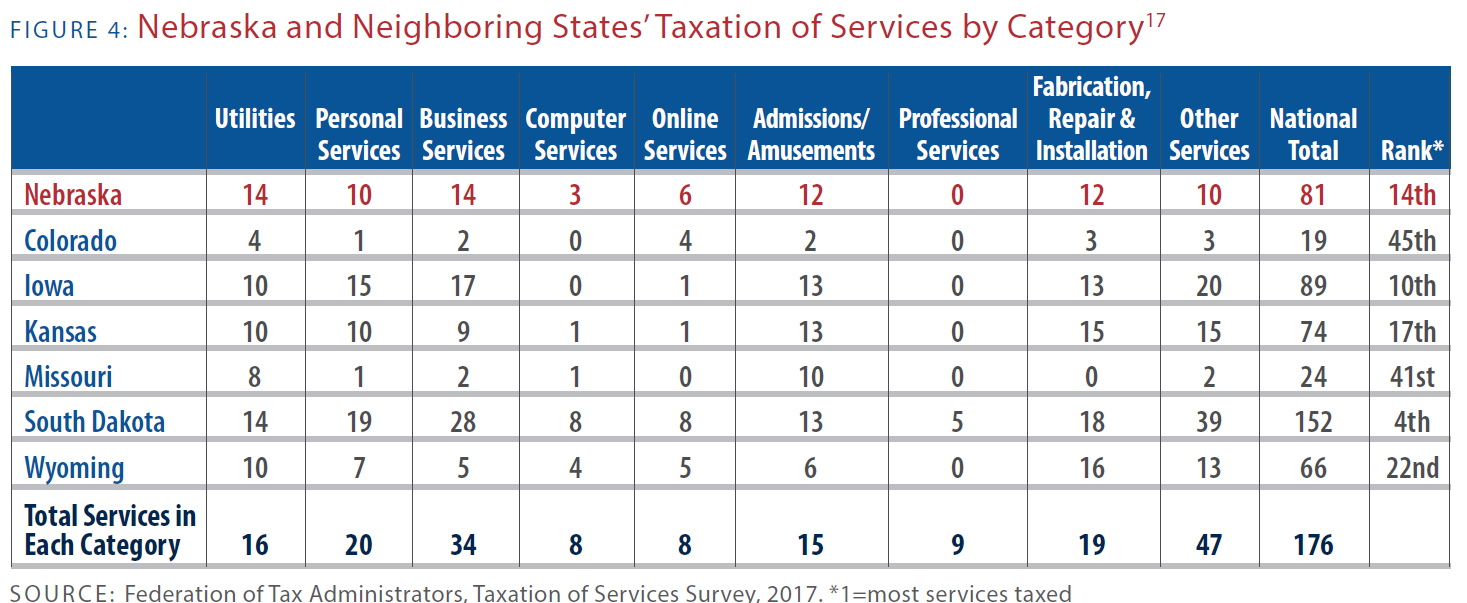

Taxes And Spending In Nebraska

Motor Vehicles Douglas County Treasurer

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Nebraska Application For Military Honor Reserve License Plates Download Printable Pdf Templateroller

All About Bills Of Sale In Nebraska The Forms And Facts You Need

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Get Real About Property Taxes 2nd Edition

Sales Tax On Cars And Vehicles In Nebraska

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan